Finance Committee Perspective on Weston’s Debt and Unfunded Liabilities

From the Weston Town Crier, April 16, 2020

Submitted by the Weston Finance Committee

As follow-up to last week’s article by the Weston Finance Committee, “Finance Committee Perspective on FY 2021 Budget and Taxes”, which detailed our lack of support for the proposed Fiscal Year 2021 town budget as recommended by the Town Manager, we want to provide some additional perspective on Weston’s debt and unfunded liabilities.

As noted last week, we do not oppose the school budget increase of 3.5%, which is 1.7% after adjusting for accounting changes and legally mandated special education expenses. Rather, we are concerned by the remaining proposed municipal budget in this unprecedented environment. We recommend deferring all significant discretionary spending and all proposed budget increases which are not absolutely necessary until after the current crisis has subsided. At that point, we may be able to restore discretionary expenses and investments on which there is already broad agreement and debate other increases as may be prudent at that time.

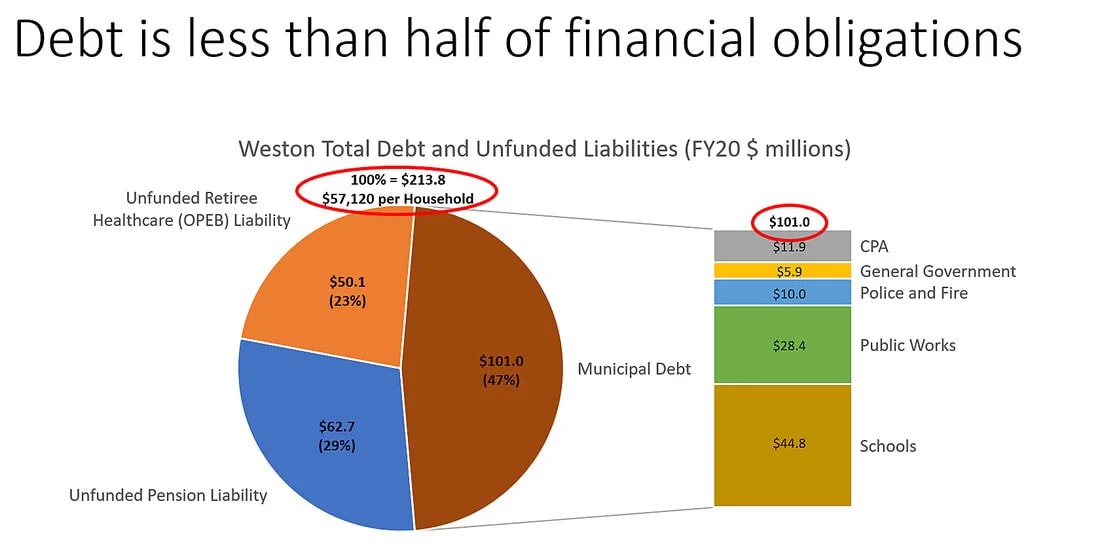

Since 1997 the Town has authorized a number of large capital projects totaling nearly $213 million. This includes major renovations of the schools, construction of the new Field School, Community Center, DPW and Police Station, an addition to the Town Hall, Case Campus Improvements, Case Estates Land acquisition, Case House Rehabilitation, Old Library (WAIC), Josiah Smith Tavern, and Town Center Master Plan and Burying of Utilities. Outstanding excluded debt against these projects (as well as several smaller projects), will total approximately $89 million in General Fund Debt and $101 million in debt when CPA projects are included. Note that this debt is well above Weston’s annual town operating budget.

We are concerned about the large number, size, and frequency of these various projects. In particular, we are extremely concerned by the potential future cost of executing the new Recreation Master Plan, which while involving some necessary fixes to current fields/facilities, also includes many “nice to have” items. In general, projects are encouraged by our practice of forming ad hoc long-term committees, which become committed to seeing them happen without regard to bigger picture trade-offs or costs. There is a tendency to analyze projects in isolation, and to focus on debt service when presenting projects to the Town (e.g. only $200 per taxpayer per year for the next 20 years) rather than considering that the debt service costs of all of these various projects add up to a significant amount for years to come. The ongoing maintenance costs resulting from an individual project must also be weighed, as these may require the addition of permanent personnel and/or equipment. In addition to the annual tax impact, this debt can ultimately also affect real estate values. When a property is eventually sold, a buyer will be looking at the overall tax bill, which is by far the highest in the state, rather than a small amount per year associated with any one project.

In FY2021, the Town’s ratio of debt service to operating revenue will be approximately 11.5% which is approaching the 15% threshold that is a guideline for a Aaa-rated municipality.

More than 80% of the Town’s budget is related to personnel costs (School and Municipal), so controlling the growth of these costs directly results in controlling the growth of the budget. For example, while sustainability must become a high priority for all Town departments, for this year we recommend exploring energy-related grants and cost savings by using a low-cost consultant or contractor, rather than adding a full-time Sustainability Coordinator at a cost of $104,000 per year. Long-term liabilities for pension and retiree healthcare (called Other Post Employment Benefits, or OPEB) continue to be significant. Outstanding debt is increasing as more large projects are added.

Weston’s total level of debt and unfunded pension and retiree healthcare (OPEB) liabilities, now approaching a quarter of a billion dollars, is far higher than in comparable neighboring affluent towns on a per household basis. In FY20, Weston’s total debt and unfunded liabilities totaled approximately $57,120 per household, up from $52,100 in FY18, itself well over twice the comparable average of about $23,300 per household (+$28,800 or +124%). Further, Weston’s debt and unfunded liabilities are over twice as large as our total annual operating budget, compared with neighboring comparable towns averaging debt and unfunded liabilities at 147% of their operating budgets.

The full Finance Committee report is available on the Town of Weston website , on the Finance Committee page, at https://www.weston.org/DocumentCenter/View/22549/Report-of-the-Finance-Committee-PDF.